New River Project

New River Project is a utility-scale solar and energy storage (power plant) project

located in Florida and currently in development by Solariant Capital

This offering was facilitated by our third-party Broker Dealer, Andes Capital. For additional details on this offering, please visit their webpage here regarding the New River Project.

Project summary

Technology

TechnologyPV + BESS

- 100 MWdc (75 MWac) photovoltaic solar on single-axis trackers

- Up to 70 MW, 2-hour (140 MWh) battery energy storage

- Site: 500 acres in Bradford County, Florida

- Generation: 203,152 MWh in the first year

Carbon offset

Carbon offset159,000 tons

- Annual carbon offset: more than 159,000 tons of CO2

- Equivalent to over 31,000 cars taken off the road or

- Equivalent to over 15,000 homes powered

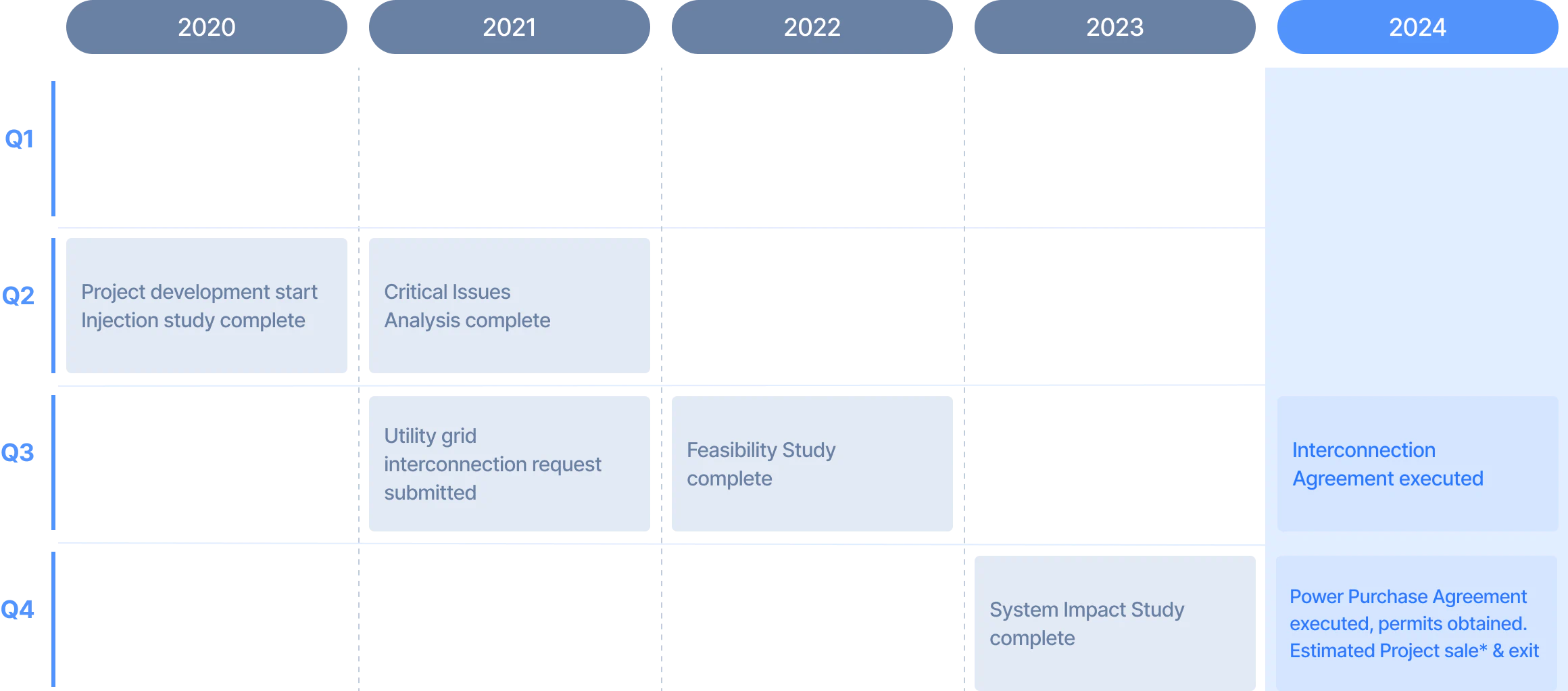

ProjectStatus

ProjectStatusUnder development

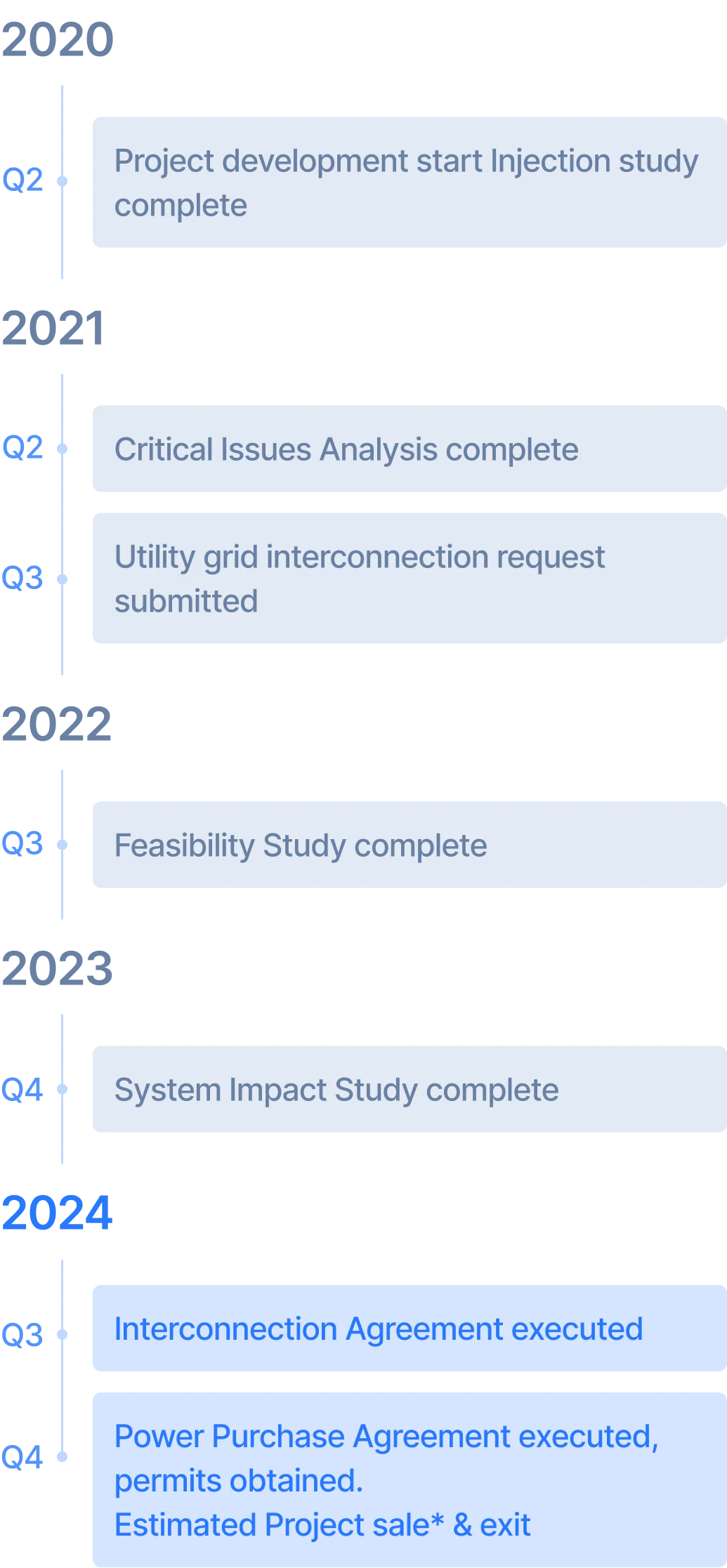

- Began development: Q2 2020

- Expected completion (exit/sale*): Q4 2024 (in 18-21 months)

- Completed: site control and title search, feasibility studies, site design and preliminary engineering, utility grid interconnection application

- In Process: permitting, detailed engineering, offtake agreement, utility grid interconnection studies and agreement, EPC and O&M agreements

More about the solar industry

Investing in solar projects

Proceeds from the sale* of the project or project company are then distributed to the investors – first, a return of the invested capital and then a pro rata share of the potential profits from the sale* according to the investor’s ownership percentage.

Solar energy project development is a well-defined process

Top reasons to invest

- 1. Direct access to solar project ownership – investors will own shares or units of solar projects in the U.S., an asset class traditionally reserved for institutional, accredited investors and private equity funds.

- 2. Acceleration of renewable energy deployment – the speed of renewable energy deployment is critical in effectively combating global climate change. By providing access to a wider pool of development capital, developers are empowered to pursue an increased number of renewable energy projects.

- 3. Experienced developer – Solariant Capital is an experienced renewable energy developer with more than 10 years of renewable energy project development experience.

- 4. Diversification to your portfolio – provides potential diversification benefits to your portfolio.

New River Solar Project

New River will provide clean electricity to Florida’s electric grid, which benefits all power consumers by adding new power supply and helping stabilize electricity prices.

- Battery energy storage connected to New River can harnesses excess solar energy generation efficiently and offers resiliency during disruptions in supply and demand for electricity

- Florida’s primary source of electricity is natural gas, presenting a prime opportunity to replace and supplement GHG-intensive power generation

- The New River Solar Project is currently in the utility interconnection queue for approval in Florida with an expected construction start date in Q4 2024.

- The New River Solar Project’s proximity to the point of interconnection with the grid should translate into reasonable facility and network upgrade requirements. These upgrades are the cost of interconnecting with the grid and typically represent a major cost variable for power plants.

- Transmission studies in the area previously showed ample available capacity for the grid to accommodate the New River Solar Project

- The development, future operation, and maintenance of the New River Solar project is an investment in the local community and provides impactful opportunities for economic development, tax revenue, and job creation across multiple sectors

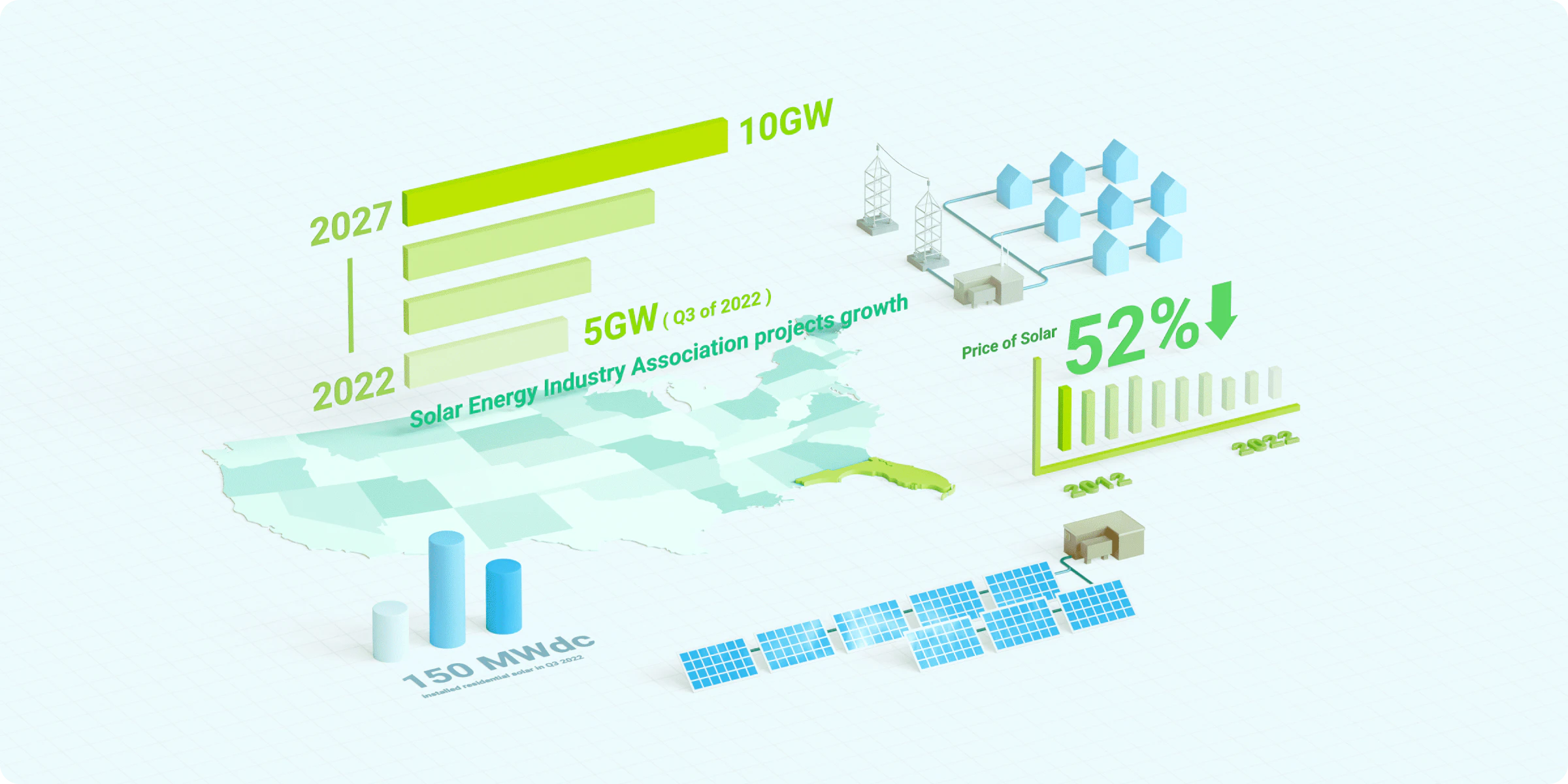

Florida solar market

- 3rd in the U.S. with approximately 9.8 GW in total installed capacity

- $13.6 billion in total solar investment in Florida through Q3 2022

- Solar Energy Industry Association projects growth of 10 GW (2x installed capacity as of Q3 2022) in additional capacity over the next 5 years

- In Q3 2022 alone, Florida installed 150 MWdc of residential solar

- Price of solar has decreased by 52% over the last 10 years

- "Florida Renewables Assessment Study" report indicates solar energy systems are cost competitive under various energy scenarios in the future

* The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.

About the team

Daniel Kim

Managing director

Kevin Kohlstedt

Head of U.S. renewables development

Andy Cerrato

Development manager

Eric Kang

Director of finance

Leesa Nayudu

VP of power marketing

Jacob Wilson

Assistant director of engineering

Project development status

Solariant Capital team members are successful, experienced project managers and developers that can effectively manage and develop projects. Learn more

- IN-PROGRESSSite control and feasibility

- IN-PROGRESSInterconnection

- IN-PROGRESSNatural resource studies

- IN-PROGRESSPreliminary engineering

- IN-PROGRESSPower marketing

- IN-PROGRESSPermitting

- IN-PROGRESSDetail engineering/constructability

- The project’s current status is outlined in the TRC report. For a detailed breakdown you can download the document .

Project timeline

* The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.