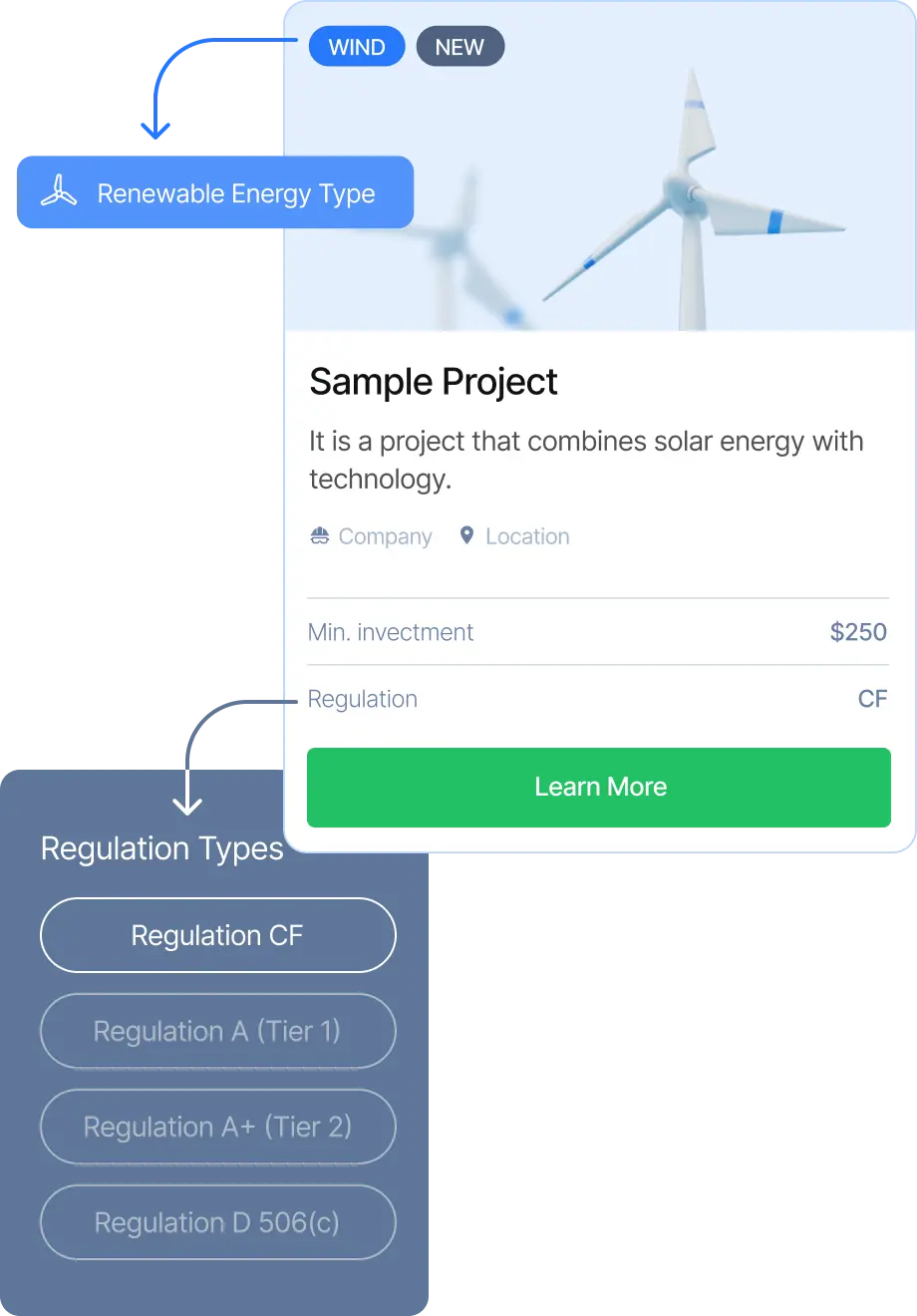

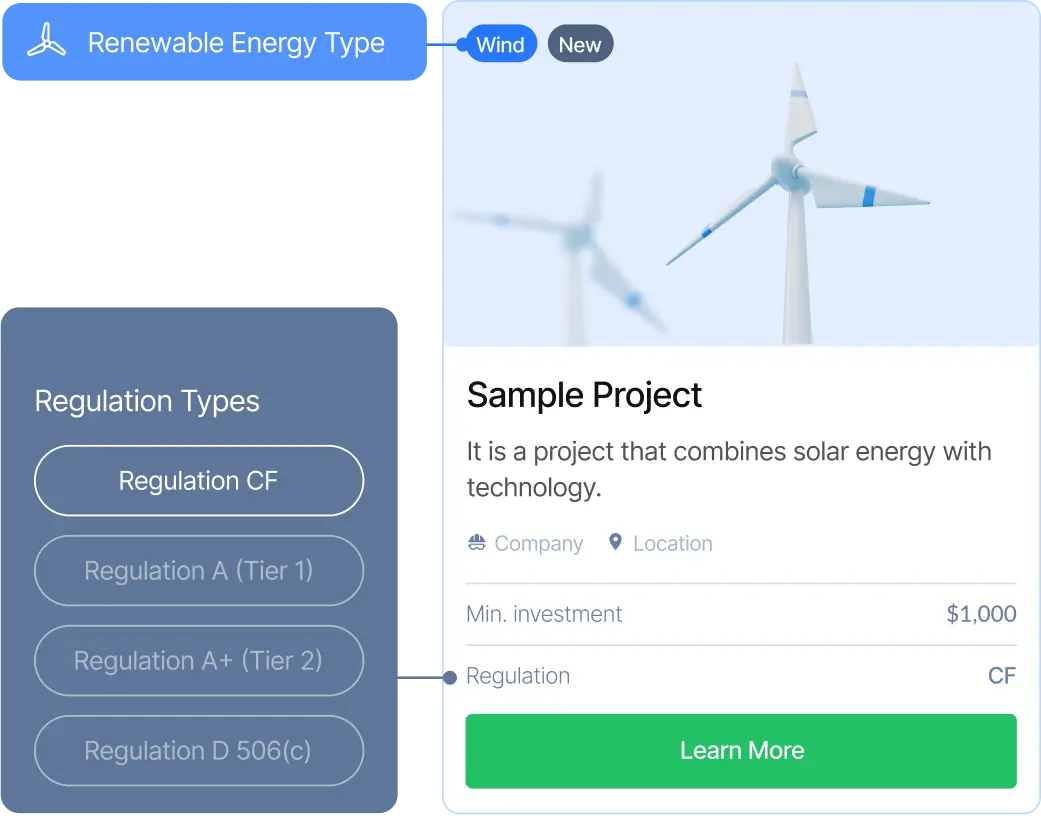

Reg CF

Equity crowdfundingRegulation Crowdfunding enables eligible companies to offer and sell securities through crowdfunding

Energy Shares’ guide to renewable

energy project investment

An investment method for accredited and non-accredited investors.

Crowdfunding is a way of funding a new venture or a project through an online portal, marketing to investing public, both accredited and non-accredited. Traditionally, private placements have been mostly available only to accredited and institutional investors. The Regulation Crowdfunding (Reg CF) provides access to these private placements to non-accredited investors.

A private placement is a sale of equity shares (or bonds) in a private company. It is an alternative to a public offering for a company to raise capital. Private placements are regulated by the U.S. Securities and Exchange Commission under Regulations CF, A, and D.

Investors can reduce risks associated with a specific asset by investing in a group of similar assets or investing in multiple types of assets, thereby possibly enhancing risk adjusted returns. It could be beneficial to diversify your investment in renewable energy projects over multiple projects rather than a single project.

Regulation Crowdfunding enables eligible companies to offer and sell securities through crowdfunding

Funding group must be incorporated into the US and must primarily do business in the US or Canada.

Regulation A is an exemption from registration for public offerings. Reg A has two offering tiers.

Must be incorporated into and primarily do business in either the US or Canada.

Regulation A is an exemption from registration for public offerings. Reg A has two offering tiers.

Must be incorporated into and primarily do business in either the US or Canada.

Regulation D is a regulation that allows smaller companies to sell securities.

Both SEC-registered and private companies can use exemption (US and foreign)

Regulation D is a regulation that allows smaller companies to sell securities.

Both SEC-registered and private companies can use exemption (US and foreign)

After an issuer submits project details and other necessary due diligence documents, Energy Shares and other third-party due diligence service providers perform due diligence to ensure the necessary documents are disclosed and filed per relevant funding regulations. Once the due diligence process is completed, Energy Shares will assist the issuer to list its offerings on the funding platform for a predetermined period to solicit investments.

Regulatory filings & diligence

Platform listing

Open investing period

Funding closes

We believe in democratizing renewable energy investments, traditionally reserved only for institutional and accredited investors and private equity funds.

Energy Shares is an innovative fintech equity crowdfunding platform focused on renewable energy investments. We are a FINRA registered broker-dealer.

For as little as $250, Energy Shares provides individual investors the opportunity to participate in the funding of renewable energy projects in the United States.

We’ve set out to democratize renewable energy investments by creating a crowdfunding platform that enables developers to raise capital from a diverse group of investors.

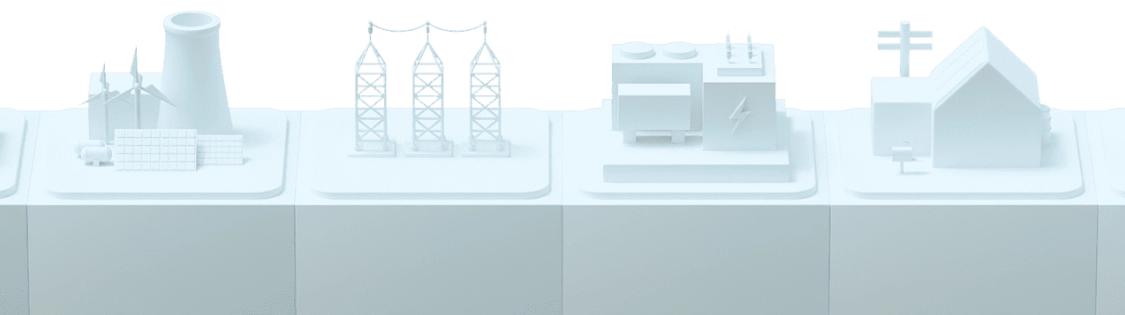

Electricity generated from renewables, such as solar and wind farms, and non-renewable sources, such as coal and gas power plants, is supplied to the grid either directly or through a reseller and then carried through high voltage transmission lines. Finally the electricity is “stepped down” to lower voltage through substations to be distributed to businesses and homes through low voltage distribution lines.

Solar energy is the most abundant of all energy resources. Sunlight is absorbed by cells in the Photovoltaic modules (PV or solar panels) and converted into electricity.

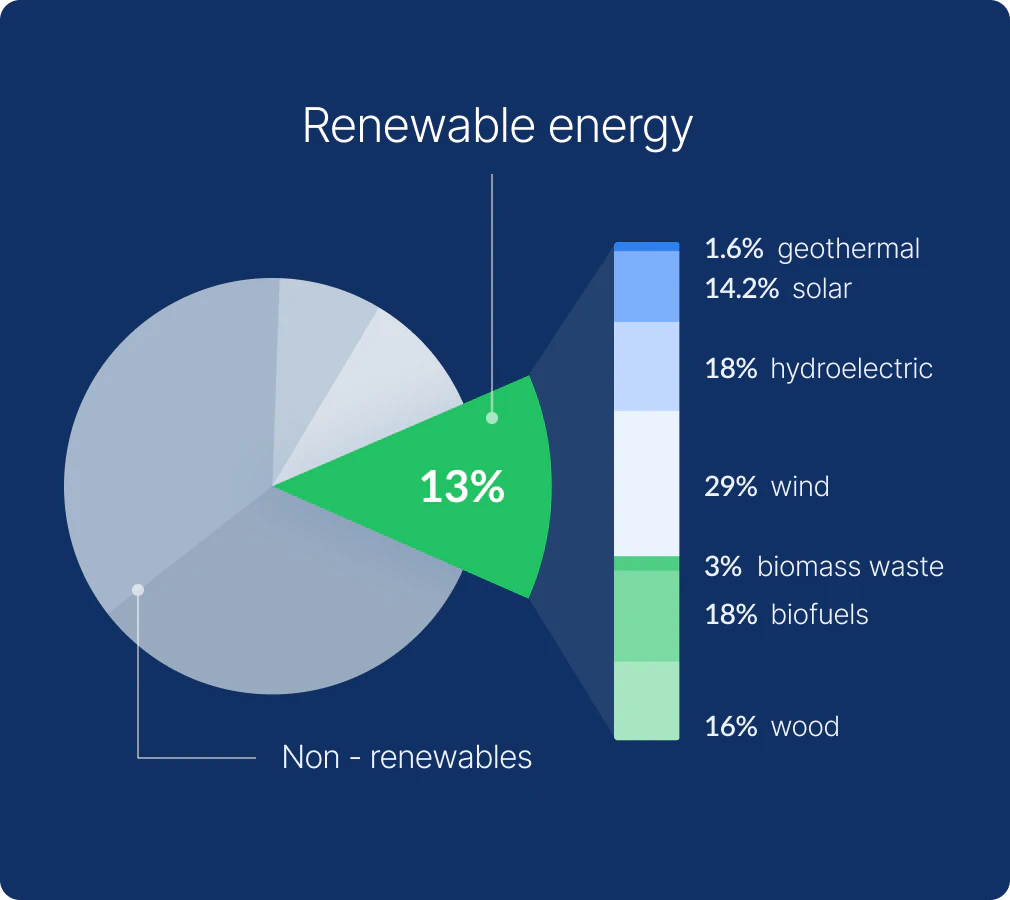

As of 2022, only 13% of U.S. energy consumption was supplied by renewable energy sources.

We believe in democratizing renewable energy investments, traditionally reserved only for institutional and accredited investors and private equity funds.

Energy Shares is an innovative fintech equity crowdfunding platform focused on renewable energy investments. We are a FINRA registered broker-dealer.

For as little as $250, Energy Shares provides individual investors the opportunity to participate in the funding of renewable energy projects in the United States.

We’ve set out to democratize renewable energy investments by creating a crowdfunding platform that enables developers to raise capital from a diverse group of investors.

Activities involve feasibility studies, securing of a suitable project site, permitting, approvals, engineering, and engaging contractors to construct and operate the renewable energy power plants. Developers often sell the projects prior to construction.

Developers enter into an agreement with an Engineering, Procurement, and Construction (EPC) company to build the renewable energy power plant according to the planned and permitted specifications.

Once constructed and tested, renewable energy power plants are operated by a third-party Operations & Maintenance (O&M) company for typically more than 20 years.

After the full life cycle of a power plant, plants are dismantled, salvageable parts recycled, and then remaining parts disposed according to regulations.

There are four key milestones to complete in renewable energy development.

Acquired through land purchase or lease option agreement.

A new generation project needs to obtain grid connection approval from the local utility, which depends on available capacity in the grid at the point of interconnection. Experienced developers typically perform a grid injection study prior to applying for grid connection in order to determine available grid capacity and locate and size projects appropriately to reduce this risk.

Various permits from local permitting agencies are necessary in order to construct a renewable energy power plant; therefore, it is important to understand the state and local laws and regulations. Experienced developers perform Critical Issues Analysis through third-party engineers as a part of their feasibility studies in order to assess the potential risks relating to permitting.

Developers need to secure offtakers (buyers) of generated electricity once the project is operational. Developers typically assess potential offtake during feasibility studies based on a number of factors including the utility's (typical energy offtaker) long-term energy resource plans and potential large corporate customers. Currently, there is a strong tailwind for the adoption of renewable energy reducing this risk. Increasing number of states are committing to 100% renewable energy adoption, and there are many corporations that are participating in the movement called RE100 (Renewable Energy 100%). The demand for renewable energy is expected to continue to accelerate in the foreseeable future.

Project exit* value (how much a project can be sold for once development is completed) depends on a number of factors, but some of the key factors are as follows:

Acquired through land purchase or lease option agreement.

A private placement is a sale of equity shares (or bonds) in a private company. It is an alternative to a public offering for a company to raise capital. Private placements are regulated by the U.S. Securities and Exchange Commission under Regulations CF, A, and D.

Investors can reduce risks associated with a specific asset by investing in a group of similar assets or investing in multiple types of assets, thereby possibly enhancing risk adjusted returns. It could be beneficial to diversify your investment in renewable energy projects over multiple projects rather than a single project.

Investors can reduce risks associated with a specific asset by investing in a group of similar assets or investing in multiple types of assets, thereby possibly enhancing risk adjusted returns. It could be beneficial to diversify your investment in renewable energy projects over multiple projects rather than a single project.

The Exit Value or Development fee of the project is included in the CAPEX for the buyers. The Exit Value or Development fee can be determined based on the resulting expected annual returns for project buyers. For example, if the expected annual market returns is 8%, we can adjust the development fee (exit value) in the cash flow model until the cash flow model results in 8% annual returns for the project buyers.

Expected Electricity Output x Offtake Price

CAPEX

OPEX (operating expenses)

Revenues – (Cash) Expenses – Debt service (project loan payments)

Calculated based on the Equity contribution and Net Cash Flows over the project life

* The sale or exit of the project cannot be guaranteed and if there is a sale or exit, a price cannot be guaranteed as several factors such as but not limited to market, economic conditions, and availability of buyers may affect the ability to exit the project.

Join 25,000+ others and get the latest in renewable energy and climate delivered straight to your inbox.